E-commerce is growing in India both customers and businesses alike have frequently wondered how great e-commerce logistics works, given the phenomenal expansion of social commerce and e-commerce businesses. To develop their business and reach millions of clients, online firms in all genres require continual assistance and partnership with e-commerce logistics suppliers. With millions of customers opting to shop online, an e-commerce business needs more efficient and productive logistics solutions to handle increasing volumes and retain their customers.

Collaborating with a dependable and trustworthy logistics partner is simply the first step for e-commerce companies. E-commerce logistics businesses come in several versions – they help online stores with shipping, packaging, and picking. They also provide a variety of different shipping services that might assist a company in expanding and reaching a wider audience.

Indian E-commerce Market Scale Up:

It is no surprise to all as a result of the pandemic that in India, from April-May 2020, a consumer report found that there was already an increase of 11% in first-time online shoppers – 16% in new category online shoppers and 30% in online shoppers with larger purchases in existing categories.

The country’s e-commerce market is estimated to grow at a 30% compound annual growth rate over the next five years and serve 300-350 million shoppers by 2025. The number of e-commerce users is expected to grow by 47% to 948 million users in India by 2025

Facts of the e-commerce Industry in India:

- 46% of the population in India shops online

- According to the analysis, India is the eighth largest market for e-commerce with a revenue of US$63 billion in 2021

- According to a Forbes Report, e-commerce In India Set To Reach $120 Billion In 2025

- According to ITLN, tier II and tier III have a faster growth rate than tier I

Rising Importance of Quick Delivery and Fast Logistics in E-commerce:

No matter what the end customer wants their packages fast and cheap. The Amazon effect has many consumers around the globe expecting packages the next day or 2-day delivery.

Most transportation is via ground, it is the primary delivery mode and it becomes the cheapest and the easiest network to establish. But how can fast logistics in e-commerce be achieved via ground only transportation in India? It is an advantage for companies that have more capital. Larger companies equip several warehouses or Distribution Centers (DCs) around India in strategic areas to make sure they meet the customer’s desire for fast and inexpensive delivery.

This means there are increased costs for e-commerce companies on real estate (buy or rental), inventory, insurance, security, and other costs to ensure customers can get their orders fast via ground transportation.

For any e-commerce company the crucial for quick delivery is last-mile delivery. The process of delivering an order from a warehouse (or fulfillment center) to the customer’s delivery address is known as last-mile delivery. In e-commerce fulfillment, the major purpose of last-mile delivery is to deliver an item to a consumer as quickly as possible, making the entire fulfillment process swift and painless. Improving last-mile delivery can now help you provide lightning-fast shipment, resulting in a positive customer experience, and repeat customers.

Furthermore, with speedy shipping options, you can stay ahead of the competition in this overcrowded e-commerce scene by lowering shopping cart abandonment and raising conversion rates. Finally, by enhancing the order fulfillment stage, you may deliver items to customers faster, please them, and encourage repeat purchases.

Changing Behavior of Customers:

The e-commerce business has caught up with a significantly more westernized youth seeking new options and prospects. e-commerce is rapidly changing, with numerous new technologies and trends on the horizon. The pandemic forced the offline retail market to close and operate at a reduced capacity. That is why; the pandemic situation became one of the key drivers fueling this expansion, as is the customer’s transition to the internet. Customers now want speed and transparency in the process of delivery.

Future of Commerce Report (India) suggests that 85% of young consumers (18-34 years) and 90% of middle-aged consumers (36-54 years) moved to online shopping during the pandemic. So, brands had to focus on creating digital experiences that met their expectations. e-commerce companies and their customers want a seamless experience to track from the cart-to-the door.

Adaptation of Innovations for Indian E-commerce Companies:

The Indian e-commerce market should learn from the US and other more mature e-commerce markets while balancing the uniqueness of the Indian e-commerce sector. How?

- Look for innovation to drive your complete customer journey including your delivery purpose

- Think of ways to reinforce the brand value and meeting the brand promise

- Search for organizations that utilize innovation to shorten delivery time

- Increase ROI by utilizing true value which is not exclusive to just the delivery costs

- Align the following technology and services to the total cost of expansion with multiple delivery options:

- The same day, the Next day, and 2+ days

- Costs of expansion and DCs by utilizing air options, not just ground options

- Extend options to customers

- Ensure technology is integrated into the e-commerce ecosystem, from e-commerce platforms like Shopify to deliver at the customer’s door

How SmartKargo can help E-commerce Companies:

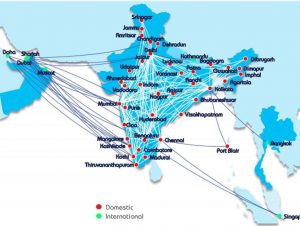

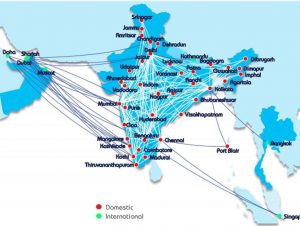

Our expertise lies in providing airspeed and ground value to e-commerce companies. We deal with e-commerce logistics across the globe, and we do not believe in a one size fits all market – we customize a solution. We ensure we are a part of the e-commerce company’s growth approach. With Air transportation you can have faster delivery – that’s a given. Our Partnered airline is already going to where your customers are –

We offer other alternatives to spending large amounts on DCs. You may not need as many DCs while using SmartKargo can be said as “Warehouse in the air” and provide fast delivery across the country which is paramount for next day delivery. One of the central issues with DCs is that it always accounts for every product all the time. Air is always fast.

Our innovative technology provides all the aspects from the purchase on the e-commerce engine to the delivery to the customer. Some of our pivotal innovations include:

- AI engine for route optimization for the last mile

- Integration into e-commerce engines out of the box

- Geolocation

- Customer Alerts

- Touchless Delivery

- Real Time insights and reporting

Speed and Value are Paramount Factors:

For e-commerce companies their logistics partner’s objective is to oversee the pick-up, and successful delivery of all orders placed with them. However, in the case of e-commerce logistics, the breadth of services is much broader. To be the most efficient, e-commerce logistics businesses must make use of the most recent technical breakthroughs.

Simply delivering the product isn’t enough in e-commerce because it serves such a broad number of demanding and eager clients. Customers expect to be able to easily track their orders and receive timely information from the e-commerce shop where they made their purchase. Proper inventory, order generation, tracking, NDRs, and returns management systems can ensure that your logistics partners make the entire process transparent to you and your consumers.

E-commerce logistics providers should ensure your customer’s journey is aligned with your brand and its brand promise. Look for those innovative companies that will extend your brand and provide the insights and analytics needed to keep you customers coming back.