Due to the epidemic, more people preferred going online to shop because stores were closed or understaffed, and people wanted to avoid being inside. In the world of e-commerce, delivery is a critical aspect in turning visitors into real buyers. Customers now look at the cost of various delivery methods first, while speed remains their second priority. According to Baymard Institute research, 16 percent of them abandon their cart because delivery is too slow.

What effect do delivery times have on conversion rates?

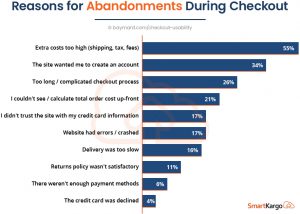

The customer’s delivery time can be a source of anxiety. The average cart abandonment rate on a website is about 70%. Customers will abandon their shopping carts less frequently if it is faster, and they will return more frequently if it is slower. Abandonment of shopping carts can happen for a variety of reasons:

- Speed of site

- Payment options

- Exorbitant shipping fees

- Lack of delivery options

If the customer’s delivery alternatives do not satisfy their expectations, customers will not hesitate to shop at another online store. An e-commerce store can be more successful thanks to quick delivery alternatives.

Schemes Marketplaces Offer For Fast Delivery

Customers like things that can be delivered quickly. By narrowing their search, the customer can discover just things that are delivered soon. Furthermore, platforms such as Amazon and eBay provide this type of product more visibility.

- The Amazon Buy Box: The yellow button with the words “add to cart” inscribed on it. It not only allows you to place the order faster, but it also allows you to stand out in such a crowded product flow.

- Amazon Prime’s Same-Day Delivery gets customers their products as fast as 5 hours.

- eBay Guaranteed Delivery: Sellers boost product visibility, and consumers receive their orders in as little as three days. It also allows for better reviews and shorter delivery times. There is a Fast ‘N Free safeguard if the deadlines are not met.

Customers are willing to spend more for a faster, more affordable delivery promise. 48% of consumers in India say they will pay more for a product if it promises swifter shipping. That’s a compelling case for e-commerce retailers and businesses to up-level their logistics business model to support fast delivery.

Nearly a quarter (24%) of customers indicated they would pay more to receive products within a one- or two-hour window of their choosing, while 41% of consumers are willing to pay a fee for same-day delivery.

Many big consumer companies and their shippers are re-evaluating everything from package shipping caps to pricing methods in general as a result of the growing emphasis on same-day delivery and shorter delivery windows.

Multiple Shipping Choices

84 percent of Internet users are willing to switch websites if they don’t have enough delivery options. E-commerce will be more appealing and will have more opportunities to convert prospects into consumers if they have speedier and more profitable logistic options.

This technique also allows for case-by-case adaptation, allowing it to better fit the needs of purchasers. It could be the key to acquiring a larger market share and a more favourable position among competitors.

Five Advantages Quick Delivery Offers

- Reduce shopping cart abandonment

- Increase conversion rates

- Increasing customer happiness and loyalty

- Increase product awareness in marketplaces

- Gain market share and become more competitive

Optimizing For Fast Delivery Without Investing Billions of Dollars

If online retailers and e-commerce businesses want to stay relevant in an Amazon-first world, they must find a solution that enables them to offer same-day or next-day delivery—affordably. They need to make the right investment to bring goods closer to their customers and optimize for the last mile. E-commerce businesses must seriously consider how they will live up to today’s consumer demands and stand out in the market because quick delivery is no longer just a nice-to-have alternative. It’s a must-have!

The solution? Add cost-effective e-commerce dedicated logistics solution that provides supply chain process optimization and delight to end customers.

SmartKargo’s E-commerce Logistic Solution enables retailers and e-commerce brands to stay agile in an ever-changing ecosystem and to meet the increasing demand for fast and cost-effective delivery. Our solution provides e-commerce businesses with a new value proposition, setting them apart from competitors. While the SmartKargo e-commerce solution brings the benefit of ultra-fast service to customers, there are plenty of advantages for e-commerce businesses too:

- We ensure to reduce last-mile transportation time and costs to offer faster delivery.

- We offer pan-India e-commerce packages delivery within a record time of 20 hours with live tracking.

- SmartKargo powered by IndiGo gives its e-commerce clients an edge in the market by providing airline support in the middle mile transportation, making the delivery process faster and more efficient. The airline’s existing belly capacity is used to ship packages, at the speed of flight.

- We maintain full transparency to customers with real-time tracking.

Bottom Line

As observed, timing is important when it comes to delivery alternatives for order fulfilment or retail operation. The effect of ecommerce is only going to grow, posing new issues when it comes to balancing delivery goals with consumer expectations.

This challenge, on the other hand, offers a lot of possibilities. Technology advancements, along with a re-evaluation of shipping and logistic methods, can go a long way toward assisting a company in meeting consumer expectations and assuring customer happiness.

Finally, in today’s corporate world, giving fast delivery alternatives is both required and critical. After all, fast delivery isn’t just something that customers want—something it’s that they’ve learned to expect.